Introduction

The Reef-Positive Businesses Initiative represents a paradigm shift in conservation finance, blending public grants with private investments to support enterprises that actively benefit coral reefs. Launched through partnerships involving the GFCR, WWF, and UN agencies, it focuses on sectors like sustainable tourism, aquaculture, and waste management. As of 2025, it has supported over 400 reef-positive businesses globally, creating at least 30,000 jobs in coastal economies [1]. The GFCR aims to mobilize up to USD 3 billion in blended finance to link climate action with economic growth [2]. However, this optimism is tempered by concerns that such initiatives may prioritize corporate image over real impact, especially as reefs suffer from escalating bleaching events [G3]. This section provides an overview of the initiative’s origins, drawing from recent reports and social media sentiments that highlight both enthusiasm and skepticism [G8, G15].

Origins and Key Mechanisms of the Initiative

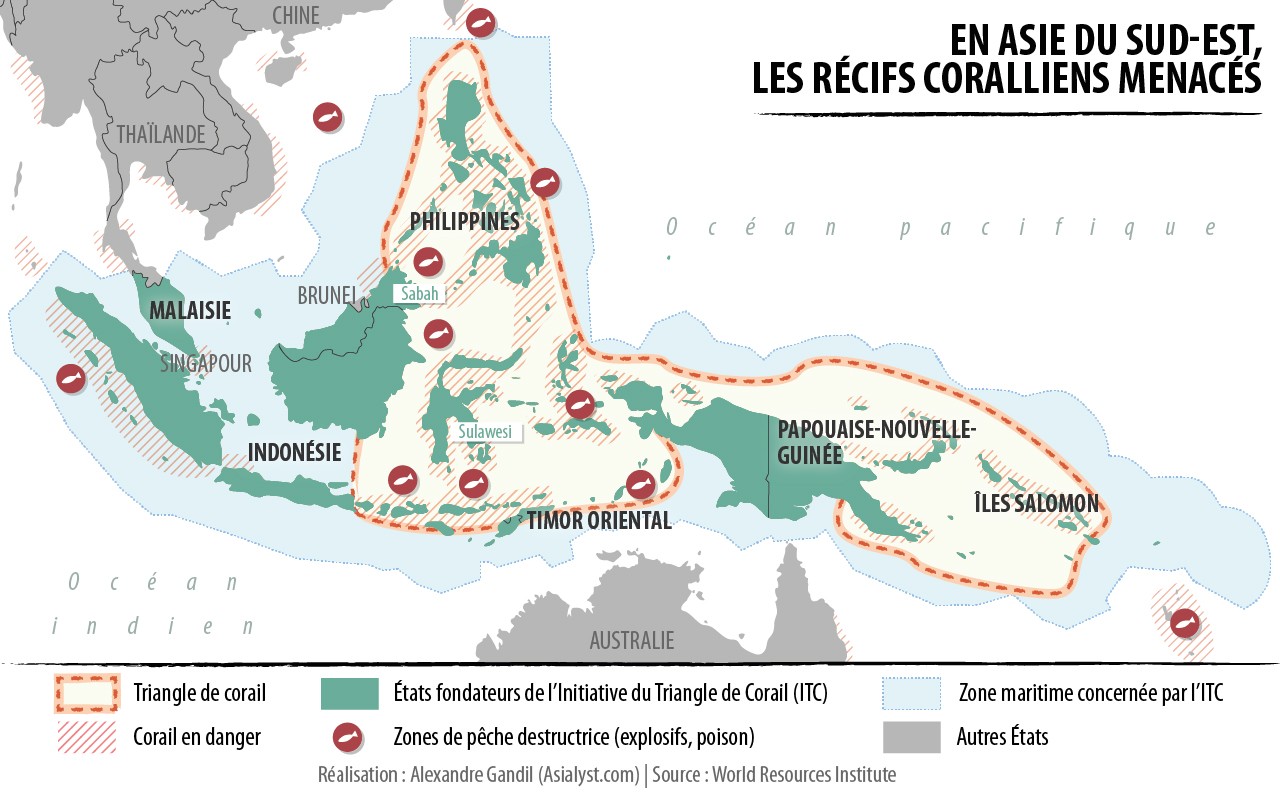

Rooted in broader efforts like the UN Environment Programme’s Green Fins, the Reef-Positive Businesses Initiative has gained momentum through innovative financing models. In November 2025, WWF-Pacific and the UN Capital Development Fund (UNCDF) launched a pilot in the Solomon Islands, targeting resilient reefs in up to two provinces with technical assistance, grants, and credit guarantees [2]. This builds on the GFCR’s portfolio across 22 coastal states, supporting community-led enterprises in regenerative tourism and circular economies [6].

Technological advancements underpin these efforts. For instance, Blue Alliance’s scalable model for Marine Protected Areas (MPAs) in Indonesia uses blended capital for investment-ready businesses, generating revenue from ecotourism and blue carbon initiatives [3]. Similarly, the GFCR’s MPA Impact Loan Facility syndicates donor funding with investor loans, offering impact-based interest relief [4]. These mechanisms have deployed over $22 million in grants and innovative tools, as detailed in a 2025 ORRAA and Blue Alliance report [5]. Yet, expert analyses warn of potential pitfalls, such as rebound effects where increased eco-tourism strains habitats [G10], emphasizing the need for science-based data to align finance with conservation [6].

Positive Impacts and Success Stories

The initiative’s proponents highlight measurable gains in reef conservation and livelihoods. In the Solomon Islands, the 2025 pilot aims to protect marine ecosystems while fostering sustainable jobs, as announced amid COP30 discussions [2]. Globally, it has created 30,000 reef-positive jobs, with the GFCR’s annual report underscoring blended finance’s role in community-led outcomes [1]. Seychelles’ Ocean’s Resolve program, launched in 2024 with GFCR support, addresses investment risks to bolster the coral economy [5].

Success stories abound: Blue Alliance’s low-impact snorkeling cruises in Indonesia fund MPAs while generating revenue [9]. X posts reflect positive sentiment, praising artificial reefs for rejuvenating ecosystems and boosting fisheries [G19]. A Nature Reviews article notes expanded protected areas through coordinated interventions, enhancing resilience against climate stressors [G3]. These examples demonstrate how reef-positive businesses can deliver economic incentives for conservation, with verifiable biodiversity benefits in hotspots like Fiji and Australia [G7, G20].

Criticisms and Greenwashing Concerns

Despite these achievements, the initiative faces scrutiny for potential greenwashing. Critics argue that voluntary corporate pledges lack enforcement, allowing image polishing without addressing root causes like emissions [G6]. A 2025 World Economic Forum report on the Great Barrier Reef’s decline links losses to cumulative pressures, including tourism amplified by “reef-positive” models [G1]. Degrowth advocates on social media contend that growth-oriented approaches fuel overconsumption, with users decrying corporate motives amid 80% global coral die-back [G16, G17].

Expert perspectives echo this: A ScienceDirect article warns that without systemic changes, initiatives risk superficiality [G10]. Social media discussions highlight human rights angles, framing reef destruction as an equity issue and calling for indigenous-led models over corporate dominance [G6, G18]. In the Solomon Islands context, while pilots promise local empowerment, there’s concern that commodifying reefs could exacerbate inequalities if governance fragments [G8]. These viewpoints suggest the initiative may inadvertently prioritize profit, undermining long-term sustainability [5, G4].

Balanced Viewpoints and Emerging Trends

Balancing these perspectives, the initiative’s blended finance model offers innovation but requires accountability. Proponents, including UN agencies, view it as essential for scaling restoration amid crises like the 2023-2025 bleaching events affecting over 80% of reefs [G9]. Critics, however, advocate degrowth principles to cap tourism and avoid rebound paradoxes [G10]. Original insights from analyses suggest that while Solomon Islands pilots empower communities, they risk amplifying pressures without binding regulations [G8].

Emerging trends include technological interventions like coral biobanking and artificial reefs, praised for sustainable fisheries [G19]. Rights-based approaches are gaining traction, integrating indigenous voices for equitable outcomes [G7]. X sentiments reflect a 2025 pivot toward resilience tech, yet underscore the need for policy shifts like carbon taxes [G15, G20]. This duality highlights the initiative’s potential as a lifeline if paired with stricter oversight.

Constructive Perspectives and Solutions

Constructive solutions focus on enhancing accountability and community involvement. Recommendations include third-party audits for businesses [G10] and integrating degrowth by limiting tourism scales [G6]. Indigenous-led models, like Australia’s Woppaburra Sea Country biobanking, offer blueprints for cultural stewardship [G7]. Active projects, such as the GFCR’s expansion at COP30 with commitments from Solomon Islands and Indonesia, emphasize credible data for effective policy [6].

Innovative tools like insurance for MPAs [5] and scalable ecotourism [9] are under study, with pilots demonstrating revenue for conservation. Experts advocate prioritizing local governance to ensure blended finance benefits ecosystems, not just investors [3, G3]. These approaches, if implemented, could transform the initiative from hype to impactful action.

KEY FIGURES

– Over 400 reef-positive businesses and finance mechanisms have been supported globally, with at least 30,000 reef-positive jobs created across coastal economies (Source: https://mptf.undp.org/sites/default/files/documents/2025-06/gfcr_consolidated_annual_report_2024_draft.pdf) {1}

– The Global Fund for Coral Reefs (GFCR) aims to mobilize up to USD 3 billion in blended finance to accelerate solutions linking climate action, ocean conservation, and inclusive economic growth (Source: https://news.fundsforngos.org/2025/11/19/new-reef-positive-finance-pilot-set-to-protect-solomon-islands-marine-ecosystems/) {2}

– ORRAA and Blue Alliance have deployed over $22 million through grants, impact loans, loan guarantees, and innovative insurance tools to support reef-positive enterprises and Marine Protected Areas (MPAs) (Source: https://illuminem.com/illuminemvoices/the-economics-of-coral-reefs) {5}

– The GFCR’s blended finance portfolio spans 22 island and coastal states, supporting community-led enterprises in sustainable aquaculture, regenerative tourism, waste management, and circular economy systems (Source: https://icriforum.org/cop30-coral-finance-meeting/) {6}

RECENT NEWS

– In November 2025, WWF-Pacific and UNCDF launched a new reef-positive finance pilot in the Solomon Islands, targeting up to two provinces with resilient reefs. The initiative combines technical assistance, investment grants, and innovative finance tools to support local reef-positive enterprises, backed by a credit guarantee facility managed by UNCDF (Date: November 19, 2025, Source: https://news.fundsforngos.org/2025/11/19/new-reef-positive-finance-pilot-set-to-protect-solomon-islands-marine-ecosystems/) {2}

– In 2024, Seychelles Conservation and Climate Adaptation Trust (SeyCCAT) partnered with the GFCR to launch Ocean’s Resolve, a program designed to foster the coral reef economy by addressing investment risks and governance fragmentation (Date: 2024, Source: https://illuminem.com/illuminemvoices/the-economics-of-coral-reefs) {5}

– At COP30, Solomon Islands, Indonesia, Papua New Guinea, and Seychelles reaffirmed their commitment to reef-positive enterprises and community-led approaches, announcing new partnerships with the GFCR, UNCDF, WWF, and UNDP to expand support for reef-positive businesses and improve coastal livelihoods (Date: 2025, Source: https://icriforum.org/cop30-coral-finance-meeting/) {6}

STUDIES AND REPORTS

– The Global Fund for Coral Reefs Consolidated Annual Report 2025 highlights that over 400 reef-positive businesses and finance mechanisms have been supported, resulting in at least 30,000 reef-positive jobs created across coastal economies. The report emphasizes the importance of blended finance and community-led approaches in achieving sustainable outcomes (Source: https://mptf.undp.org/sites/default/files/documents/2025-06/gfcr_consolidated_annual_report_2024_draft.pdf) {1}

– A 2025 report by ORRAA and Blue Alliance details the deployment of over $22 million through a mix of grants, impact loans, loan guarantees, and innovative insurance tools. The investment model is designed to generate revenue from community-based aquaculture, sustainable fisheries, ecotourism, and blue carbon initiatives, delivering measurable impact for donors, financial returns for investors, and long-term sustainability for MPAs (Source: https://illuminem.com/illuminemvoices/the-economics-of-coral-reefs) {5}

– The COP30 Presidency Coral Finance Meeting outcomes report notes strong convergence around the GFCR as the central multilateral instrument for coral reefs, with participants highlighting the need for credible, science-based data to ensure alignment between financing tools and effective conservation policy (Source: https://icriforum.org/cop30-coral-finance-meeting/) {6}

TECHNOLOGICAL DEVELOPMENTS

– Blue Alliance has developed a scalable financial model for large-scale Marine Protected Areas (MPAs) in Indonesia, deploying early-stage blended capital to create investment-ready businesses that align conservation with blue economy development. The model leverages revenue streams from responsible ecotourism, community-based aquaculture, sustainable fisheries, and blue carbon initiatives (Source: https://oceanriskalliance.org/project/scaling-finance-for-indonesias-mpas-through-reef-positive-investments/) {3}

– Blue Alliance has expanded its reef-positive tourism model with a low-impact snorkelling liveaboard cruise brand, designed to fund marine protection and generate sustainable revenue streams for MPAs (Source: https://bluealliance.earth/ecotourism-impact-investment-indonesia/) {9}

– The GFCR-supported MPA Impact Loan Facility syndicates catalytic donor funding with impact investor loans to grow the pipeline of reef-positive businesses, with investors agreeing to impact-based interest relief (Source: https://globalfundcoralreefs.org/reef-plus/events/investing-in-reef-positive-businesses/) {4}

MAIN SOURCES

- Global Fund for Coral Reefs Consolidated Annual Report 2025.

- New Reef-Positive Finance Pilot Set to Protect Solomon Islands Marine Ecosystems.

- Scaling finance for Indonesia’s MPAs through reef-positive investments.

- REEF+ | Investing in Reef-Positive Businesses.

- The economics of coral reefs: Why invest, why now.

- Outcomes of the COP30 Presidency Coral Finance Meeting.

- Brief MAR+Invest 07.2025.

- Ensuring effective protection: Marine protected areas in action.

- Sustainable Ecotourism Model Deployed to Strengthen Marine.